For any of you that have been following my blog, you recognize that I have been on a health journey to improve my physical health so I can best serve my family and school community. Today, I wanted to spend a bit of time discussing fiscal health, which is another aspect of healthy living.

As a school principal, one of the ways I support our school in appropriately using our school funds is to ensure that everyone has an understanding of our “Why” and our values are aligned to that common purpose. For our school, one of our shared values is: “Students First,” when considering spending: our team evaluates if the item is aligned to our values.

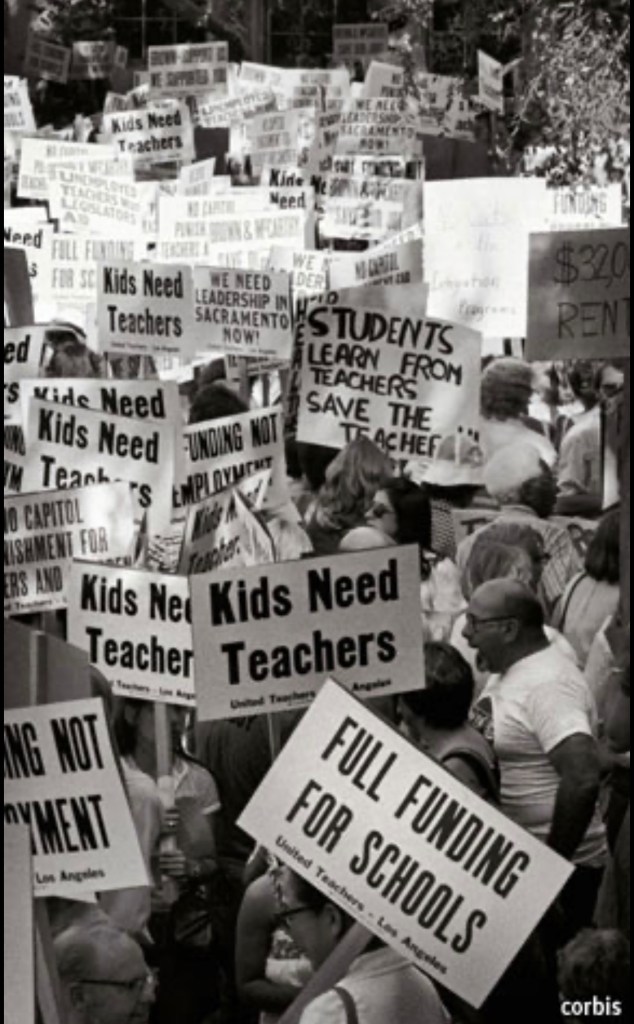

In light of the Covid-19 Pandemic, school budgets have been hit hard. There are less resources and more need for staff and PPE to effectively physically distance. Schools shutdown and went into “distance learning” in a matter of days. Governor Newsom has cut the education budget by 10% and is asking for additional federal funding to support. As our Nation’s economy has been impacted, the ripple to taxes will be felt in education.

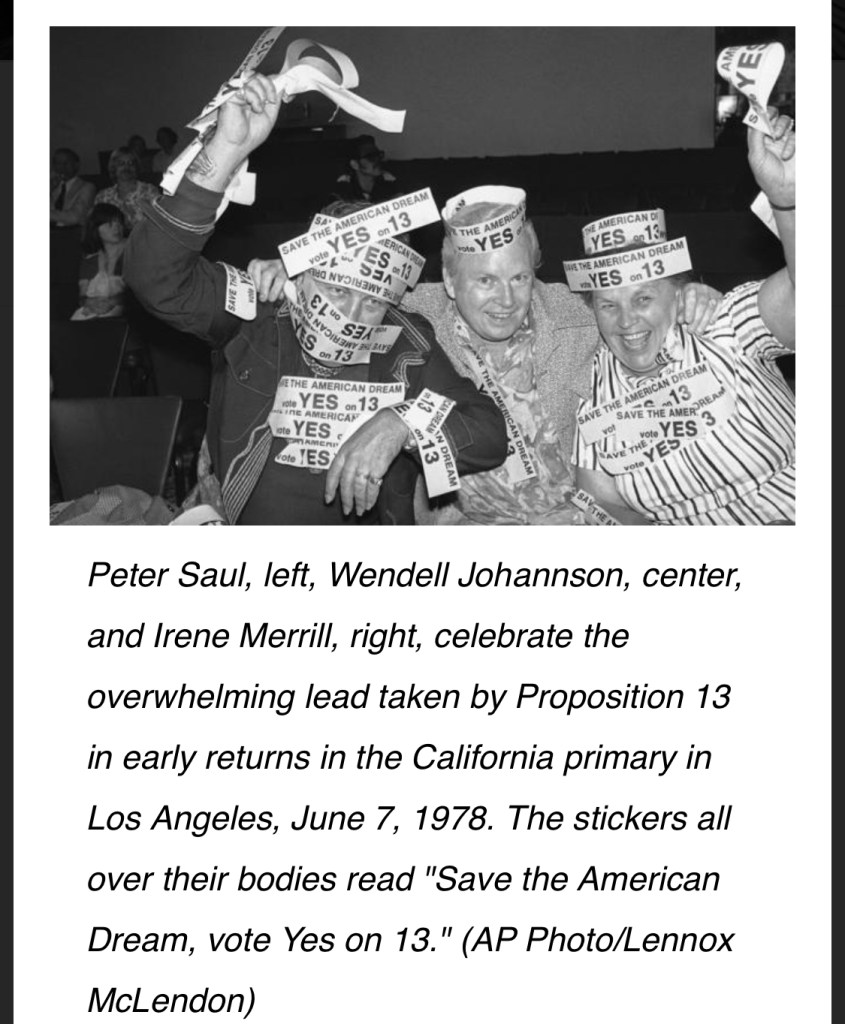

Proposition 13 (1978), which created a statewide property tax rate set at 1 percent of assessed value and limited annual increases in assessed value (Weston, 2012). This was a victory for the homeowners, but had negative implications for education. With less revenues going towards the schools, the issues of equity became more prevalent. There were “have and have not” situations happening at schools. Schools that had a community that could augment their funding were able to offer enrichment programs, where other were in a state of disrepair.

Assembly Bill 8 proposes districts in the state to have a student to counselor ratio of 400-to-1 by the end of 2022 (Raymundo, 2019). This bill would cost about a $120 million dollars and would be funded out of the state’s general fund. In light of increasing social emotional needs in students, this bill makes sense, but yet again, the question arises about the funding source. Are the voting public’s values aligned with educators’? some districts have been proactive and have applied for grants to augment social emotional learning, and have been able to hire elementary school counselors. As a principal in one of those districts, I can attest to the positive impact a school counselor can make on a campus, but what about districts that have not been able to afford/prioritize school counselors. As students and staff return to school as the pandemic subsides, how can this inequity be addressed? This goes back to the idea of a “why” are our values aligned to our actions and expenditures in education, or as a state?

The Gann Limit, (Proposition 4) was passed a year after Proposition 13, and limited the amount that state and local government (including school districts can legally spend (Gevercer et al, 2018). When Proposition 98 was passed in 1988, it stated that the extra money from the Gann Limit, would not be refunded to the tax payers, but would be allocated towards education. The passage of Proposition 98 attempted to address issues of equity in allocation of educational resources, by investing extra monies into schools.

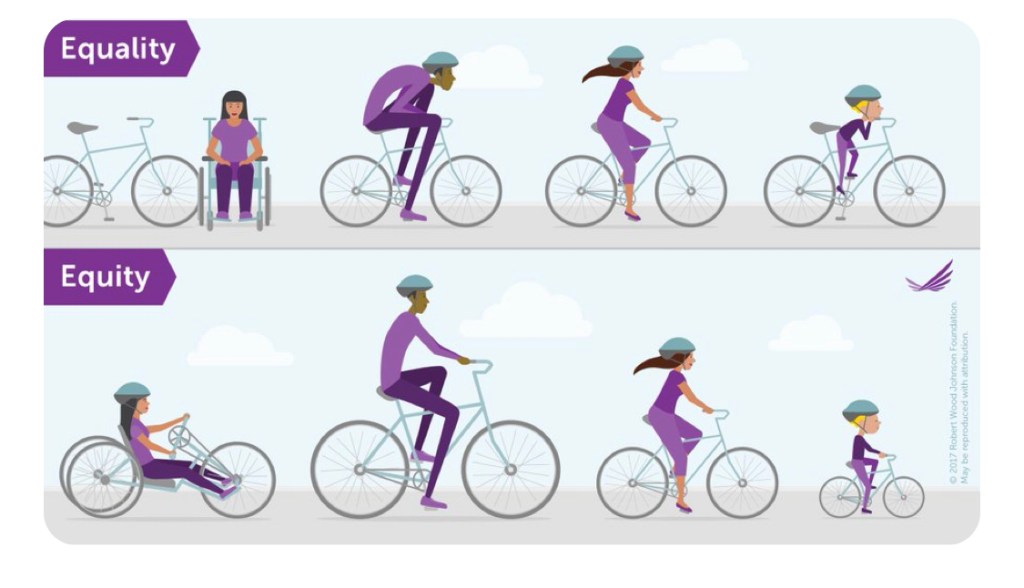

All of this legislation brings us back to this idea of equality versus equity. When thinking about school funding and tax payers, the relationship needs to be mutually beneficial. The tax payers need to see the benefit of investing in education without drastically impacting their personal finances. Ensuring equity is imperative! So, let’s get back to our “Why” as a state, why is education important, why should we invest in students? If we do not have a common vision and shared values, our “Why” becomes muddied, and legislation that benefits one group over another is passed. Is it possible the way to get back to a healthier fiscal state would be creating a strong vision and set of values that would guide spending and budget decisions?

References:

EdSource. (2020, May 22). Education and the coronavirus crisis: What’s the latest? Retrieved from https://edsource.org/2020/education-and-coronavirus-whats-the-latest/625119

Gevercer, B., Dodson, S., Grodin, J., & Little, R. (2018, January 8). How the Gann Limit Interacts with Cap-and-Trade. Retrieved from http://scocablog.com/how-the-gann-limit-interacts-with-cap-and-trade/

Raymundo, S. (2019, March 29). AB 8 Aims to Provide Districts with Funding for Additional Mental Health Counselors. Retrieved from https://www.thecapistranodispatch.com/ab-8-aims-provide-districts-funding-additional-mental-health-counselors/

Weston, M. (2012, November). School finance. Retrieved from https://www.ppic.org/publication/school-finance/