The purpose of taxing allows for the individuals to collectively support the public service institutions. “The term tax serves as a firm reminder to people that they have been given personal and mandatory responsibility to divert a certain amount of their wealth—past, present, or future—to become part of the revenue” (Brimley, Vertegen, & Garfield, 2012, p. 114). An effective tax system requires that every person pay some taxes to the government. When taxing individuals it is important to consider equity issues. “First, horizontal equity requires that those taxpayers in similar circumstances should be treated equally. Second, vertical equity requires that taxpayers in different circumstances should be treated according to those differences” (Brimley, Vertegen, & Garfield, 2012, p. 115).

The public service sector is dependent upon the private wealth in order to survive. Ensuring that taxpayers have an understanding and buy-in of what their taxes will fund is imperative, or they could lobby to lower or eliminate certain taxes , which could result in negatively impacting public services. “Taxation theory requires diversification with a broad tax base—such as income, sales, and property—so that an individual’s “escape” from a particular kind of tax does not mean complete exemption from paying a tax of any kind. (Brimley, Vertegen, & Garfield, 2012, p. 116)

Equity and Ability-to-Pay: “Taxes are considered fair if they contain features of progressivity with the largest percentage falling on individuals with higher incomes. (Brimley, Vertegen, & Garfield, 2012, p. 117). Using a progressive tax structure causes individuals who earn more to proportionally pay more into the system.

Adequacy: “Maintenance of the extensive services of government requires large amounts of tax revenue“ (Brimley, Vertegen, & Garfield, 2012, p. 117). A tax system is considered adequate when it provides enough revenue to meet the public service demands.

Cost of Collection: “To the extent possible, taxes should have relatively low collection and administrative costs for both the government and the individual” (Brimley, Vertegen, & Garfield, 2012, p. 117). The government is interested in the net revenue from the taxes collected.

Predictability and Stability: Predictability of stable sources of revenue allow the government to make more accurate budget predictions, which allow for appropriate funding of all public services (Brimley, Vertegen, & Garfield, 2012).

Difficult to Evade: Evading taxes is when an individual willfully elects to not pay taxes. “Shifting taxes to the point that the impact of a tax (the point of tax imposition or the person who receives the bill) is different from the incidence of that tax (the person who finally pays the tax) makes taxation extremely delicate and difficult to regulate” (Brimley, Vertegen, & Garfield, 2012, p. 118).

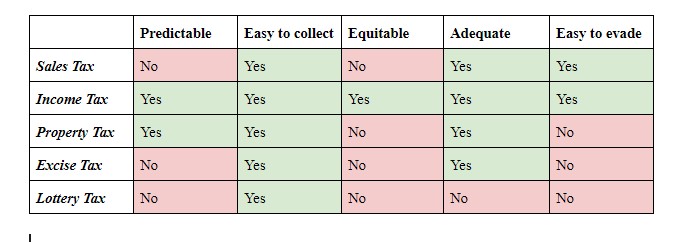

Sales Tax: “Produce large amounts of revenue and is one of the most transparent ways to collect taxes, but its use without exclusion of necessary goods and services tends to overburden poor families” (Brimley, Vertegen, & Garfield, 2012, p. 129). Revenues generated from sales taxes increase during good economy as more individuals are spending and decrease during tough financial times.

Income Tax: “The personal income tax is usually a progressive tax levied on the income of a person received during the period of one year” (Brimley, Vertegen, & Garfield, 2012, p. 127). Income tax includes personal and corporate income taxes. This tax is a progressive tax, where individuals and corporations that earn more are taxed at a higher percentage rate.

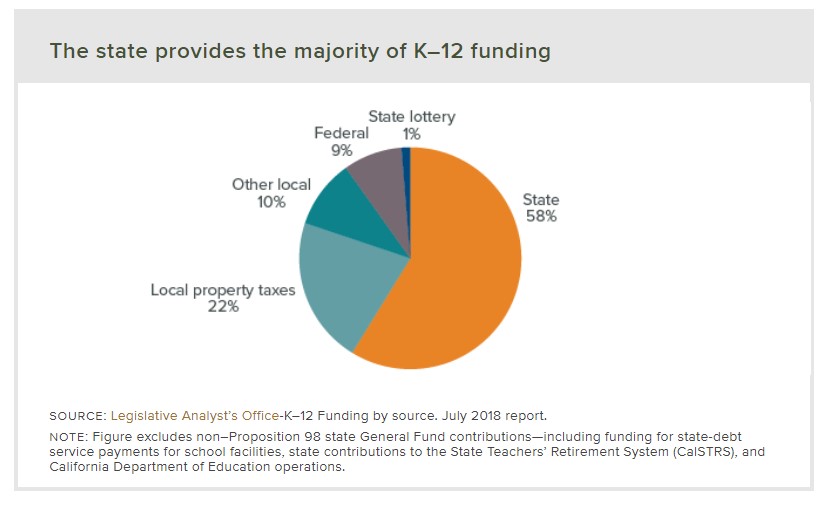

Property Tax: “Property taxes were the first kind of school taxes, and they still constitute almost the complete local tax revenue for schools” (Brimley, Vertegen, & Garfield, 2012, p. 130). Property taxes are a reliable source of revenues for the schools, and are considered to be stable and are nearly impossible to avoid paying.

Excise Tax: “An excise tax, also called a sumptuary tax, is sometimes imposed by the government with the primary purpose of helping to regulate or control a certain activity or practice not deemed to be in the public interest” (Brimley, Vertegen, & Garfield, 2012, p. 134). Some examples are alcohol and tobacco. The 2019 Tax Resource reported in California, the merchant is taxed, but often they pass the cost of this tax on to the consumer.

Lottery Tax: “Thomas Jefferson called the lottery a “wonderful thing, it lays taxation only on the willing.” (Brimley, Vertegen, & Garfield, 2012, p. 136). Individuals voluntarily purchase lottery tickets, but often this system is seen as a regressive tax structure because the individuals that spend them most are the ones who earn the lowest income.

Highest Ranked Tax System: Based upon the criteria, the income tax collection would be the highest ranked. It allows individuals to pay on a progressive scale, which supports being equitable.. Essentially, people are paying what they can afford versus everyone paying a flat tax rate. The collection of a flat tax would more drastically impact an individual who has a lower income. In terms of adequacy, collecting income taxes is a steady source of revenue for the government. The challenge that arises with income taxes are the loopholes, individuals can evade paying taxes (Brimley, Vertegen, & Garfield, 2012).

Lowest Ranked Tax System: The lottery tax would be the least effective tax to collect. It is dependent upon individual whims to purchase tickets, and is prone to fluctuations making it difficult to predict. “Since lotteries only generate a small percentage of total state allocations, school administrators need to be concerned about relying on this source because of the uncertainty of receipts” (Brimley, Vertegen, & Garfield, 2012, p. 142). The lottery tax is not an equitable tax because of the regressive nature of it, and in terms of adequacy, it does not generate enough funds to make a significant impact in the budget.

Best Tax Structure for Education: “Most states still use the income tax, the sales tax, and the property tax as their most reliable and lucrative sources of revenue” (Brimley, Vertegen, & Garfield, 2012, p. 118). Considering the needs of equitable funding in all districts, and the need to balance out the inequities that property tax funding can create, using income based tax collection to fund schools seems like the best conclusion. Income based collection is equitable to all taxpayers because it is a progressive tax structure. The challenge arises that in a low socio-economic area, or rural area, the adequacy of funding might not be present. Taxes would have to be centralized and distributed based on the need to create an equitable education funding system. Currently, as the job market is evolving, many employers are moving towards having staff be “independent contractors, “ which could create several loopholes, as individuals do not pay the appropriate amount of taxes. in terms of adequacy of funding.

Property taxes are able direct form of taxes that are easily collected with most taxpayers understanding the purpose. few. “The property tax at the local level has proved to be a good and reliable source of revenue for operating schools and providing many other services of city, town, and county government” (Brimley, Vertegen, & Garfield, 2012, p. 130). After much reflection, it appears that property taxes are still an adequate source of funding for schools, and as more taxpayers are educated on how the funds are used, hopefully they will be open to paying a slightly higher rate of property taxes to support K-12 education.

References:

Brimley, V., Verstegen, D. A., & Garfield, R. (2012). Financing education in a climate of change (Eleventh). Hoboken, NJ: Pearson Education, Inc.

Characteristics of an Effective Tax System. (2019, December 9). Retrieved from https://okpolicy.org/resources/online-budget-guide/revenues/an-overview-of-our-tax-system/characteristics-of-an-effective-tax-system/#:~:text=Adequacy means that taxes must,the basic needs of society.&text=Simplicity means that taxpayers can,taxes, forms and filing requirements.

The 2019 Tax Resource. (n.d.). Retrieved from http://www.tax-rates.org/california/excise-tax